Table of Contents

- Understanding the ECN (Electronic Communication Network) Mechanism

- Real-Time Order Matching and Execution

- The Role of Liquidity Providers in ECN Networks

- Direct Market Access (DMA) in ECN Trading

- Key Advantages of DMA for Traders

- Benefits of ECN Trading

- Conclusion

Summary:

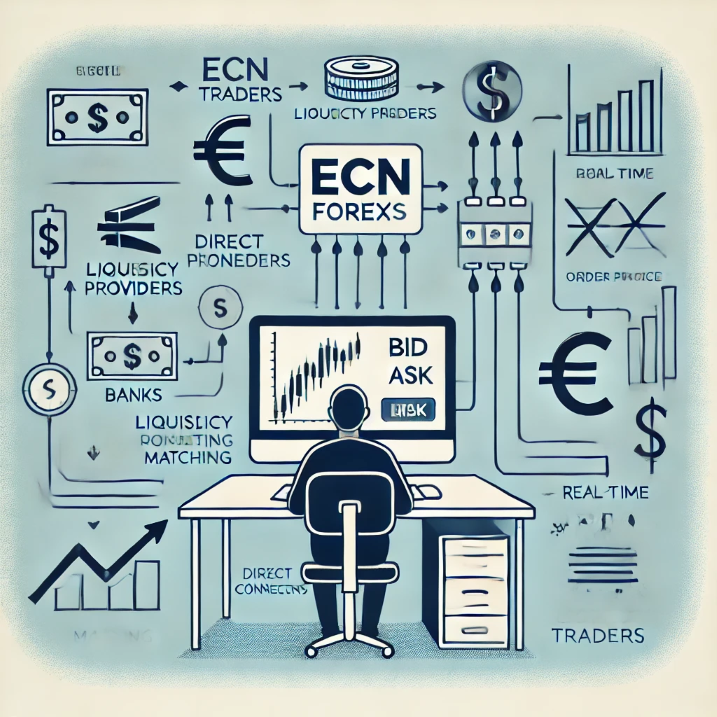

ECN (Electronic Communication Network) Forex trading is a modern, technology-driven system that connects traders directly to the global currency market, bypassing traditional intermediaries. This decentralized network matches buy and sell orders in real-time, providing traders with direct market access (DMA) to competitive bid and ask prices from multiple liquidity providers, including banks and financial institutions. By leveraging this transparent and efficient mechanism, ECN trading offers faster execution, tighter spreads, and a fairer trading environment, making it a preferred choice for many Forex traders.

In the world of Forex trading, Electronic Communication Network (ECN) trading has become a popular choice among traders seeking more transparency, direct market access, and competitive pricing. Unlike traditional trading models, ECN Forex trading leverages advanced technology to streamline the buying and selling process by connecting traders directly to a network of liquidity providers. In this blog post, we’ll explore how ECN Forex trading works, from its core mechanism to the role of liquidity providers, and how it benefits traders through real-time order matching and execution.

Read more >> What is ECN Forex Trading?

Understanding the ECN (Electronic Communication Network) Mechanism

At its core, ECN trading is a digital trading system designed to automatically match buy and sell orders in the Forex market. It serves as a bridge between traders and major financial institutions, such as banks, hedge funds, and other liquidity providers, ensuring efficient and transparent trading.

In ECN trading, brokers do not act as intermediaries controlling pricing or execution. Instead, they provide access to the network where all participants can interact freely. Traders place their orders into the ECN system, where the network matches them with the best available bid or ask price from other traders or liquidity providers. This decentralized approach ensures that orders are executed at the most competitive prices available in real-time.

Real-Time Order Matching and Execution

One of the defining features of ECN Forex trading is the speed and efficiency of real-time order matching. When you place a trade on an ECN platform, the system automatically searches for the best available counterparty to match your order. The ECN aggregates prices from various liquidity providers, including banks and financial institutions, ensuring that traders have access to highly competitive bid and ask prices.

Here’s a simplified breakdown of how the process works:

- Order Placement: A trader submits a buy or sell order via an ECN broker. The order includes details such as the desired currency pair, trade size, and preferred price (if using a limit order).

- Order Matching: The ECN system scans its network for the best available counterparty to match the trade. If it’s a market order, the system will match it with the current best bid or ask price available in the network. For limit orders, the system looks for a counterparty willing to buy or sell at the specified price.

- Order Execution: Once a match is found, the ECN executes the trade in real time. This ensures that the trader benefits from the most competitive pricing and rapid execution.

The ability of ECNs to match and execute orders in milliseconds is a significant advantage, particularly in the fast-moving Forex market, where price fluctuations can occur rapidly.

The Role of Liquidity Providers in ECN Networks

Liquidity is crucial to the functioning of ECN trading. Liquidity providers are large financial institutions such as banks, hedge funds, and institutional investors that inject buy and sell orders into the ECN. These providers ensure there is always sufficient trading volume and available counterparties to execute trades.

Here’s how liquidity providers contribute to the efficiency of the ECN system:

- Price Aggregation: Liquidity providers continuously submit bids and offers into the ECN, creating a pool of prices for each currency pair. The ECN aggregates these prices and offers traders the best bid and ask prices available at any given time.

- Ensuring Market Depth: Liquidity providers add depth to the market by ensuring that there are sufficient buy and sell orders at different price levels. This means that traders can execute trades of various sizes without significantly impacting the market price.

- Reducing Slippage: By offering a broad range of prices from multiple sources, liquidity providers help reduce slippage – the difference between the expected price of a trade and the actual executed price. In high-liquidity environments, trades are more likely to be executed at the desired price, leading to more accurate and favorable outcomes for traders.

Direct Market Access (DMA) in ECN Trading

Direct market access (DMA) is one of the most attractive features of ECN Forex trading. In simple terms, DMA allows traders to interact directly with the market, bypassing the need for intermediaries or dealing desks.

With DMA, traders can access real-time pricing and order books, enabling them to see the full depth of the market. This transparency is especially valuable for advanced traders, as it allows them to make informed decisions based on current market conditions.

Key Advantages of DMA in ECN Trading:

- No Re-Quotes: In traditional Forex trading, brokers may re-quote prices when market conditions change rapidly. In ECN trading, DMA ensures that traders can execute trades without dealing with re-quotes, leading to faster and more reliable execution.

- Transparency in Pricing: DMA allows traders to view real-time bid and ask prices directly from liquidity providers. This means that the prices traders see are reflective of the true market conditions, free from any broker manipulation.

- Improved Execution Speed: Since ECN trading involves direct market access, orders are executed almost instantaneously. This speed is particularly crucial for scalpers and day traders who rely on quick execution to capitalize on small price movements.

- Access to Market Depth: DMA gives traders access to the market’s full depth, meaning they can see the number of buy and sell orders at various price levels. This can help traders gauge market sentiment and identify potential support and resistance levels.

Benefits of ECN Trading

Now that we understand the core mechanism of ECN trading, let’s summarize its key benefits:

1. Transparency:

ECN trading provides unmatched transparency by offering traders real-time access to market prices and liquidity levels. Traders can see the actual bid and ask prices from liquidity providers, eliminating the risk of price manipulation by brokers.

2. Lower Costs:

Thanks to its competitive pricing structure, ECN trading often results in lower spreads compared to traditional market makers. While ECN brokers may charge a small commission per trade, the overall cost is usually lower, especially during periods of high liquidity.

3. Faster Execution:

With real-time order matching and execution, ECN trading ensures that trades are processed quickly and efficiently. This feature is particularly valuable in volatile markets where every second counts.

4. Access to Deep Liquidity:

Through the participation of multiple liquidity providers, ECN trading offers deep liquidity and tight spreads, giving traders the flexibility to execute large orders without significantly impacting the market price.

Conclusion

ECN Forex trading offers a modern, transparent, and efficient way to trade the global currency markets. By providing direct market access, real-time order matching, and deep liquidity, ECN trading eliminates many of the inefficiencies associated with traditional market-making models. Whether you’re a day trader looking for fast execution or an investor seeking transparency and competitive pricing, ECN trading offers a dynamic solution tailored to the needs of today’s traders.

For those looking to take their trading to the next level, understanding how ECN trading works is essential in making informed decisions that can enhance profitability and trading performance.